In finance, every process matters. A delayed loan approval can push a customer to another bank. A small compliance slip can turn into a regulatory headache. Even a missed follow-up can damage trust.

Business process management in finance (BPM) is about preventing these cracks before they spread. It helps financial institutions redesign the way work moves, from routine tasks like account opening to complex processes like anti-money-laundering checks.

The result isn’t just faster operations. It’s fewer errors, stronger compliance and customers who feel valued because things get done right the first time.

Business process management (BPM) tackles any disruption in finance head-on. It gives financial institutions a structured way to handle core banking operations and reduce the risks that come with manual processes. Here are some of the other reasons why BPM is inevitable for financial services.

Business process management in finance isn’t just theory; it shows up in the daily operations of banks and financial institutions. By combining process automation, workflow management and BPM tools, organisations can turn complex processes into structured, repeatable workflows.

Here are some key areas where BPM enables change:

By aligning existing processes with automation technologies, BPM allows the financial services industry to optimise workflows and deliver greater business value with fewer resources.

Business process management (BPM) in finance isn’t just about cutting costs; it’s about transforming how financial institutions run their core banking operations.

From loan processing to financial reporting, BPM tools give banks and other financial organisations a way to simplify complex processes and turn them into structured workflows. But like any large-scale change, the journey comes with both benefits and challenges.

1. Operational efficiency

Financial institutions run hundreds of daily tasks, including accounts payable, credit card processing, customer onboarding and compliance checks. When these tasks are handled manually, they slow down business operations and increase the chance of human-driven errors.

BPM software automates repetitive tasks, links multiple systems and ensures process execution is consistent. The result is leaner operations and faster turnaround times.

2. Cost savings

Every delay or error adds hidden costs. For example, if loan applications pile up because of manual reviews, not only do customers face long waiting times, but the bank also spends more on staff hours and risk management.

By standardising and automating processes, BPM enables cost savings that compound across the organisation, from fewer reworks to reduced resource dependency.

3. Regulatory compliance management

In the financial services industry, compliance isn’t optional. Whether it’s anti–money laundering (AML) checks, financial reporting or data protection, one slip can lead to fines or reputational damage. With BPM, compliance rules can be built into workflows.

Document-centric BPM ensures records are complete, while integration-centric BPM connects different systems to create reliable audit trails. This makes regulatory compliance easier to manage and track.

4. Customer satisfaction

For customers, finance is about trust. If account openings take weeks or transactions fail midway, they lose confidence. BPM makes customer-facing processes like onboarding and financial transactions smoother by removing friction.

Faster approvals and accurate service delivery improve the overall customer experience and increase loyalty in a highly competitive financial sector.

Related read: Effective customer retention strategies in finance

1. Legacy system integration

Many financial institutions still rely on core banking operations built decades ago. These systems are rigid and often incompatible with modern BPM tools.

Integrating workflow automation and automation technologies into such systems can be costly and time-consuming. Without a phased plan, BPM projects risk delays or partial adoption.

2. Change management

Technology is only half the story. The other half is people. Employees who are used to human-driven processes may resist new BPM workflows. Training, clear communication and involving teams early in the process are critical to ensuring adoption. Without buy-in, even the best BPM software won’t deliver its full potential.

3. Data security

Finance deals with sensitive information, financial transactions, customer records and regulatory documents. If BPM systems aren’t implemented with strong governance, there’s a risk of data breaches.

Encryption, access control and ongoing monitoring must be part of the BPM lifecycle to ensure security is never compromised. To ensure these measures are effective, conducting an ISO 27001 internal audit helps identify gaps in your BPM system’s security controls and ensures compliance with international information security standards.

4. Ongoing optimisation

BPM isn’t a “set it and forget it” system. Regulations evolve, customer expectations shift and new automation technologies emerge.

This means processes need continuous monitoring and refinement. Tools like process mining and workflow management help identify bottlenecks, but financial institutions must stay committed to ongoing optimisation for BPM to deliver long-term value.

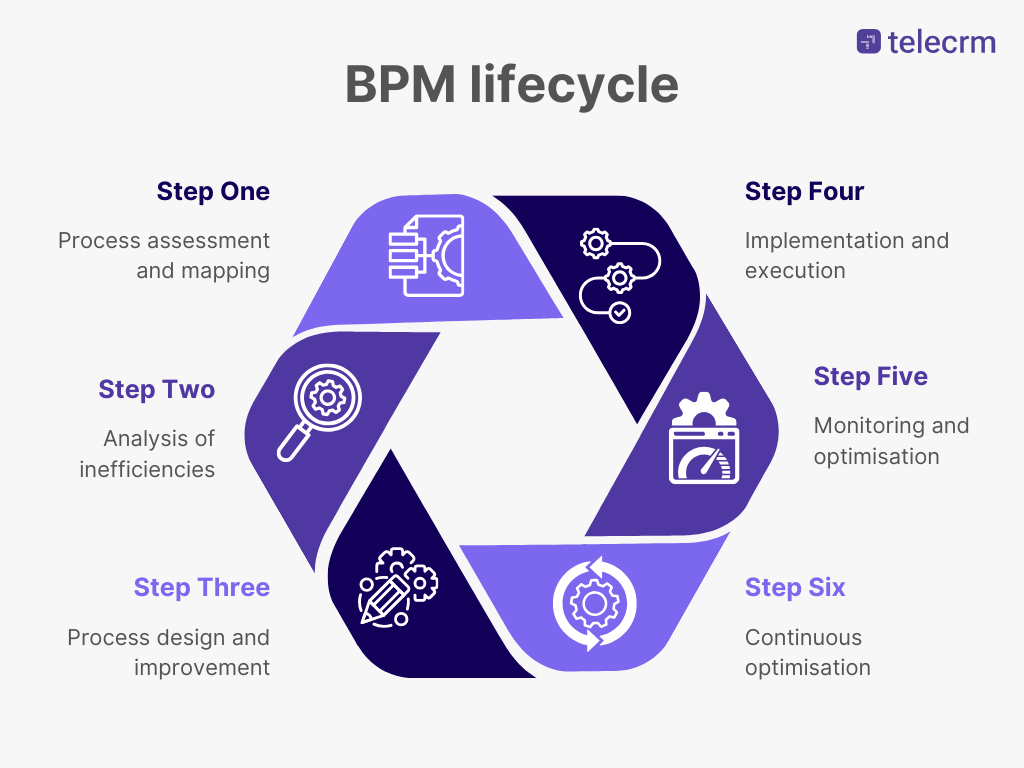

Business process management in finance isn’t a one-time setup. It’s a continuous cycle where processes are designed, tested and improved to meet changing business objectives and regulatory needs. Financial institutions usually follow a structured BPM lifecycle that ensures every stage of their operations — from loan processing to financial reporting — runs smoothly.

Here’s how the BPM lifecycle works in the financial sector:

The first step is to study existing processes. Financial institutions look at business operations like customer onboarding, accounts payable or credit card processing to see how they currently work. This stage identifies gaps, bottlenecks and risks such as manual errors or compliance delays.

Once workflows are mapped, the next step is to dig into the pain points. For example, are loan approvals delayed because documents move between multiple systems? Are compliance checks too dependent on manual processes? This phase uses process mining and data analysis to highlight where optimisation is most needed.

With clear insights, financial institutions create a process model for better execution. This might mean using workflow automation to connect steps that were previously separate or introducing BPM tools to standardise document handling. The goal here is to design a workflow that balances efficiency with regulatory compliance management.

New processes are deployed with BPM software or automation technologies. For instance, repetitive tasks like daily transaction reconciliations can now be handled by robotic process automation. This stage ensures the process is live and employees are trained to follow the new system.

BPM doesn’t stop at execution. Financial operations need constant monitoring to check if the new workflows deliver the expected cost savings, operational efficiency and customer satisfaction. Tools like dashboards and workflow management systems track progress, while the monitoring phase identifies new areas for process improvement.

The cycle repeats. As customer expectations change, regulations evolve or new automation technologies appear, processes are refined. For financial institutions, this ensures long-term agility and greater business value from their BPM projects.

For financial institutions, business process management (BPM) is only as effective as the tools behind it. Modern BPM software combines automation technologies, workflow management and data analytics to keep processes standardised, efficient and compliant. Here are some of the key technologies that drive BPM in the financial services industry:

BPM software acts as the backbone of process management. It allows banks and other financial institutions to design, model and monitor processes, from customer onboarding to loan processing. With built-in workflow automation, routine tasks like document checks, approvals or daily financial reporting move without manual intervention.

RPA handles repetitive tasks that don’t require human judgment, such as updating records across multiple systems or reconciling accounts payable. By automating these human-driven processes, RPA reduces errors and frees employees to focus on higher-value business functions.

Financial operations often span multiple systems, core banking platforms, compliance tools, payment gateways and customer relationship management systems. Integration-centric BPM connects these systems, ensuring data flows smoothly between them and reducing the friction of manual transfers.

Financial services are document-heavy, from loan applications to regulatory reports. Document-centric BPM ensures that every file is stored, tracked and accessible. This is especially important for processes like anti–money laundering checks and financial crimes monitoring, where missing paperwork can mean compliance risks.

Process mining tools help financial institutions identify inefficiencies in existing processes. By analysing how tasks move across banking operations, they highlight delays, bottlenecks or unnecessary steps. Combined with analytics dashboards, they support continuous optimisation across the BPM lifecycle.

Modern BPM projects often rely on low-code or no-code tools. These allow financial institutions to build and adapt workflows quickly without deep technical expertise. For the banking industry, this means faster adaptation to changing regulations or customer expectations.

Together, these BPM tools give financial institutions the ability to optimise processes, ensure regulatory compliance management and create greater business value from their operations.

Technology/Tool | Example use case in finance | Key benefits |

BPM software & workflow automation | Automating loan processing and account opening | Faster turnaround and consistent execution |

Robotic process automation (RPA) | Reconciling accounts payable or updating multiple systems after transactions | Reduces errors and frees staff from repetitive tasks |

Integration-centric BPM | Connecting core banking operations, CRM and compliance systems | Seamless data flow across multiple systems |

Document-centric BPM | Managing loan applications, AML records and compliance reports | Standardised, audit-ready documentation |

Process mining & analytics | Analysing onboarding or financial reporting workflows | Identifies bottlenecks and supports process optimisation |

Low-code / no-code platforms | Building workflows for customer complaints or financial crimes monitoring | Quick adaptation to regulations and customer expectations |

Together, these automation technologies form the backbone of BPM in the financial services industry. They enable financial institutions to simplify business operations, ensure regulatory compliance management and deliver greater business value over time.

In the financial industry, efficiency and trust depend on how well processes are managed. From customer onboarding to banking processes like loan approvals or financial reporting, even small delays can affect outcomes. Business process management in finance (BPM) offers a structured way to bring order and clarity.

With the right mix of business process automation, project management discipline and business process management software, financial institutions can design standard business rules, optimise workflows and make sure compliance stays on track. This isn’t just about technology; it’s about process optimisation that allows banks and other players in the banking and financial services sector to adapt quickly while keeping customers at the centre.

For financial institutions ready to move forward, BPM is no longer optional. It’s the foundation for smoother operations, stronger compliance and long-term customer trust in an industry where precision matters most.

© Copyright 2025 Telecrm.in - All Rights Reserved • Privacy Policy • T&C

© Copyright 2025 Telecrm.in - All Rights Reserved • Privacy Policy • T&C