Today, everyone with a webcam and a Zerodha account calls themselves a financial guru. And because there is so much free information available, most consumers believe they don’t need a professional advisor. Your audience now expects a 20% return each month because of the wild promises made by these self-proclaimed gurus.

To be successful as a financial advisor in India in 2025, just saying you are SEBI registered or showcasing your expertise isn’t enough; you must show your clients how to sustainably make money without resorting to get-rich-quick schemes.

As a professional financial advisor, you can either:

First, settle for the list of clients that you already have and watch your growth decline and die over time.

Second, you can develop a system to snatch clients away from the quacks and provide real value to them.

If you are still reading, I’d say it’s because you want to be the second type.

Essentially, the types of financial advisors who need growth

How you can utilise your CRM to grow your business depends on which of the above three types you are.

With numerous CRMs available on the market, selecting the right one can be overwhelming. That’s why we’ve put together a comprehensive guide to the best financial advisor CRMs available, so you can make an informed decision and focus on what you do best, providing top-notch financial advice to your clients.

The first step for your financial advisor business is lead generation. Business growth literally means more deals and you cannot have that unless you get more high-quality, qualified leads. Here’s a brief on how lead gen works for different types of financial advisors.

You can get 200 calls per day, but if none of them become your customers, then your net business growth will be zero.

If you’re serious about business growth, you can’t do it alone. In fact, if you are really fast, you will have to work on making sure that your clients get the results that they want, while there’s a dedicated person whose job it is to do business development. If you are a bigger company or an influencer, this can be more than one person or the entire team.

Everybody tries to sell, but most of them end up with complaints like:

Here’s a fact: You cannot change the market, but you can change how you operate.

Because very few people do it systematically.

If you can standardise some very basic sales and business development practices, then in the long run it will give you much higher returns compared to your competitors who are using some sales or business development hack.

Once you have some number of leads, the next step in unlocking growth is having a systematic approach to effectively engage those leads all the way to conversion.

Lead capture: You have to continuously track and optimise the best sources of your leads, this means you always need to know:

How many leads are you getting over time?

Which platforms are getting you the best leads?

Are they relevant?

1. First contact: How fast are you able to contact these leads?

If somebody is looking for financial advice, all your competitors are chasing them. This means your team needs to be the first person that contact them in order to get a real chance at closing the deal.

2. Lead requirement tracking: On the first call, the lead will tell you his problems and if you want to get a chance at actually closing the deal, then you have to take note of those problems. Then, in the process of business development, show them how you are the best person to solve these problems. You cannot do that unless you have a clear track of the conversation you had with them.

3. Capturing the right information: Lead does not necessarily mean business growth; the only way to actually ensure growth is to make sure you’re working on the right leads. One way to find the right leads is by qualifying them with the right questions and storing that data in order to filter out relevant leads. E.g. – People who want to invest but don’t have sufficient surplus capital.

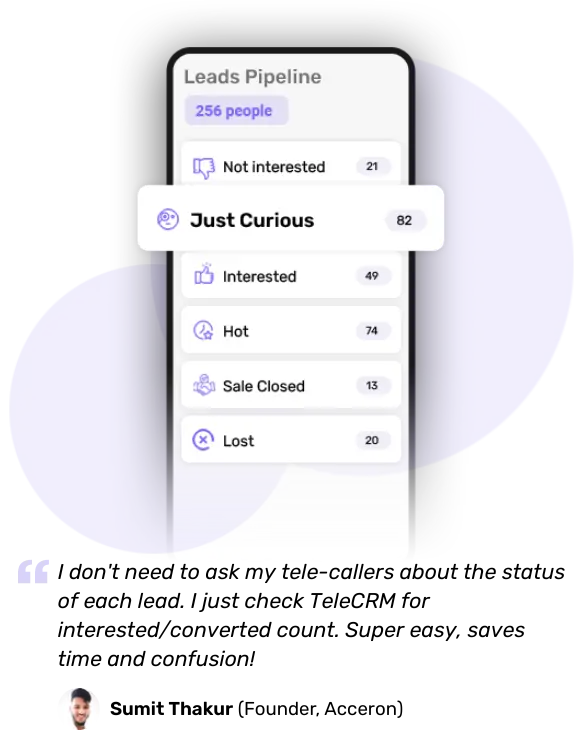

4. Lead management: You or your sales team can be working really hard and still not close any deals if they are focusing on leads that are not likely to close. This is why you need to be able to find relevant leads directly based on the conversations that you have with them. You won’t be able to do that unless you actually have a log of the conversation and their requirements with lead management software.

5. Data security: What if your sales team works super hard to turn leads into deals and just before they close, these deals get leaked out to your competitors?

6. Team productivity: If you just do not have the right tools set up to do their best work then you are losing out on revenue and growth. Your teams are losing their incentives and your competitors are closing your leads. Here are some things you can do using CRM that can boost the productivity of your team members.

7. Automate repetitive tasks like dialling: You can use Telecrm auto-dialer to make sure that your team spends zero time manually typing numbers and instead focuses primarily on talking to and convincing prospects.

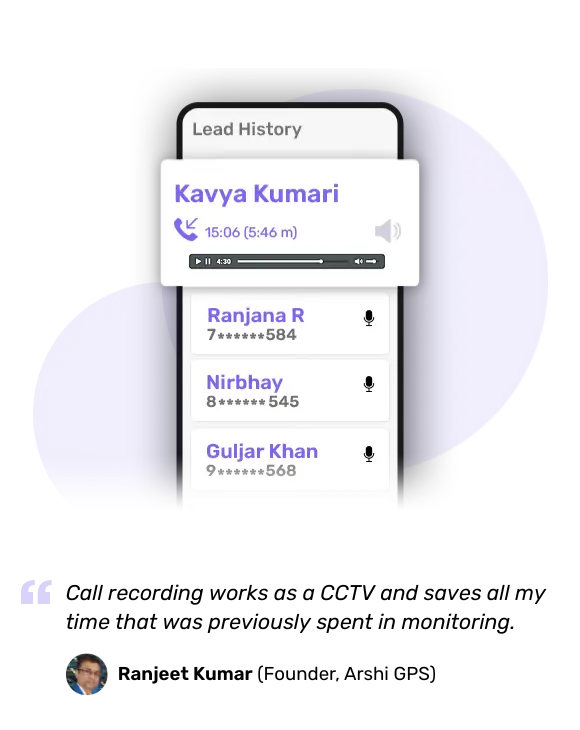

8. Call recording: You need to monitor whether your team members are making any calls and whether they are having the right conversation with your leads. The only way to make sure of that is to record each and every conversation they have.

9. Team performance tracking: If you’re busy with your business, then you don’t have the time needed to crunch 15 different Excel sheets to get a sense of who in your team is doing their job and who is not. This is why you need a CRM that will automatically generate and give you reports, if not in real-time, then at least at the end of every day. telecrm reports are generated in real-time.

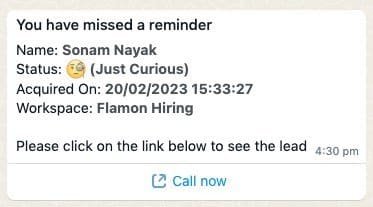

10. Call reminders: Every successful sales rep will agree that timely follow-up is the biggest factor in closing more deals and you cannot do that without proper call reminders. Because no matter how efficient your team members are, they cannot be making calls, closing deals and then managing all the follow-ups manually using an Excel sheet. This is why it is critical to have a system in place that intuitively and automatically takes care of follow-ups and sends timely reminders to your team members.

11. Follow-up calendar: The one question that every sales rep needs to answer before starting their day is – what are my important follow-ups for today? And the right CRM for your business needs to answer that question with a single click.

12. Growth hacks: You can have the best systems in place, but every once in a while, the systems go nuts and your targets rise. That’s when you need a little bit of help from growth hacks and the right CRM needs to have the capability to accommodate those growth hacks.

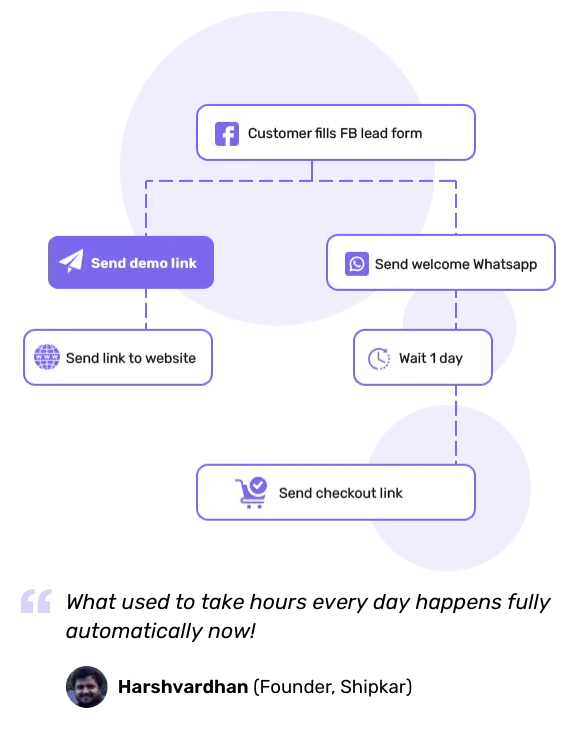

For example, Telecrm supports built-in growth hacks like sending WhatsApp messages immediately after a call with a single click. And reaching your entire audience at once with a single click using WhatsApp marketing.

Once you have decided what features are critical for your business, let’s look at the five best CRM for financial advisors and how they compare to this particular feature set.

Here are some of the best financial advisor CRMs in India, based on these specific parameters

Telecrm is one of the most powerful CRM for financial advisors in India. In India, financial advice selling happens over the phone and as the name suggests, Telecrm is built specifically as software to manage telesales for financial service providers.

1. Lead capture: Telecrm provides instant auto-lead capture from 15 different platforms, along with custom API integration that you can integrate with any platform of your choice to get notified instantly after you receive a lead anywhere

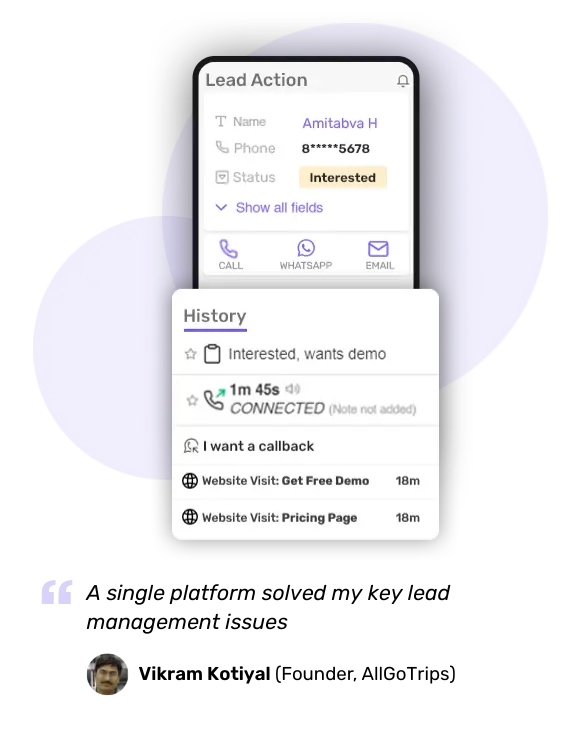

2. First contact: With Telecrm, you can get WhatsApp notifications for every lead you receive and then you can call each lead instantly with a single click directly from your WhatsApp.

3. Lead requirement tracking: Telecrm captures leads and maintains the entire history of each and every lead in a single timeline so that no information is ever lost and you can access everything from a single screen anywhere.

4. Capturing the right information: Telecrm fields are completely customisable according to your needs, so you can structure and organise the information that you need to capture at your team’s convenience.

5. Lead management: Telecrm has several different ways to dispose of leads, which means that at the end of the month, as a business owner, you have a rich set of data telling you exactly how many relevant leadyou have in your pipeline and the best campaign that you need to run to close those leads.

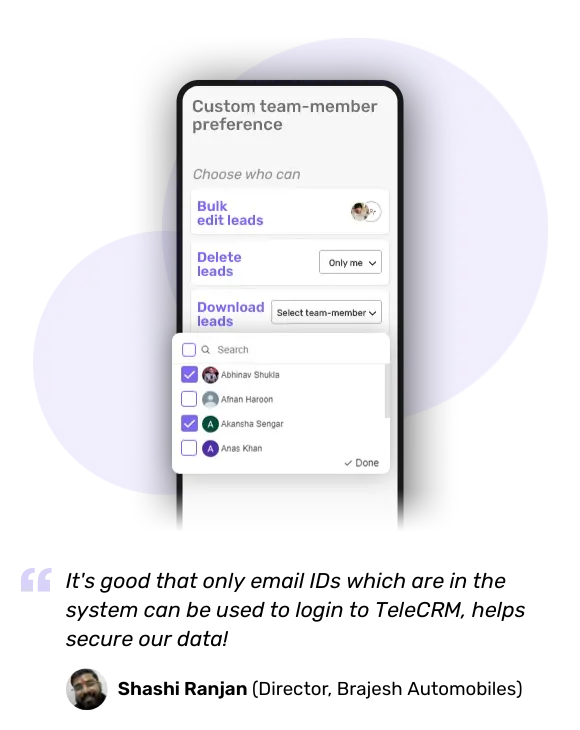

6. Data security: You can manage permissions and hierarchy, deciding exactly who has access to what data and what they can do with that data inside Telecrm.

7. Team productivity: All the team productivity features like autodialer, automatic call recording, team performance tracking, call reminder and follow-up calendar come in with Telecrm at no additional cost whatsoever.

8. Growth hacks: Telecrm empowers you to implement growth hacks like WhatsApp blast marketing, WhatsApp sequences scheduling and drip marketing automation to help you get that additional boost of leads whenever you need it to meet your sales and growth targets.

Sage CRM is a powerful customer relationship management tool that helps sales teams focus on the most lucrative and winnable deals. With Sage CRM, sales teams can easily identify cross-selling and up-selling opportunities and track their progress in real-time.

1. Lead management: Sage CRM does have workflow and lead management features that can help businesses manage leads from acquisition to conversion. These features can help automate and streamline the lead management process, making it easier for sales and marketing teams to track and manage leads and opportunities.

2. Lead Capture: Sage CRM also includes other tools and features that can be helpful for lead capture and management, such as the ability to create and distribute online forms and track & analyse customer interactions.

3. Data Security: Sage CRM uses encryption to protect data stored in the cloud, making it inaccessible even if disk drives are physically obtained.

4. Team Productivity: Sage CRM’s Team functionality allows you to group employees by job duties and track their activities, sales and customer support pipelines in one place.

5. Automated tasks: The traditional way of handling revenue recognition, customer invoicing and budget modifications can be extremely time-consuming and labour-intensive. This can lead to accounting departments being bogged down with unnecessary work, impacting their ability to provide efficient and accurate services to their clients.

Sage CRM software can automate many tasks that accounting departments traditionally have to handle manually. You may use invoice software for small businesses to manage your finances more easily, automating tasks and reducing errors. This can help to free up time and resources so that accounting departments can focus on more important tasks.

The software provides a complete view of the customer lifecycle, allowing companies to develop cross-selling and up-selling opportunities pertinent to each stage. This information is essential for companies looking to improve their chances of success.

SugarCRM is a customer relationship management (CRM) software that helps businesses manage their interactions with customers. It offers features such as sales automation, marketing automation and customer support. SugarCRM is known for its flexibility, ease of use and open-source nature.

1. Lead Capture: Visitors to your website or other online destination can quickly turn into leads in your Sugar instance with the help of SugarCRM.

2. Lead Management: SugarCRM’s lead management system segments leads based on factors such as industry, channel, lead source & geography and creates targeted offers.

3. Team Productivity: Sweet Hierarchy by SugarCRM provides a clear view of the account hierarchy within your organisation, helping to increase the productivity of your sales team.

4. Data Security: SugarCRM has multi-factor authentication to limit access to unauthorised individuals

5. Growth Hacks: SugarCRM allows users to receive timely updates on important accounts and to automatically analyse relevant data from various social and business sources.

Wealthbox CRM is a cloud-based CRM software designed specifically for financial advisors. It offers features such as client management, task management and integrations with other financial software. Wealthbox CRM is known for its user-friendly interface, customisation options and mobile access.

1. Lead Capture: The integration between Wealthbox and LeadsBridge makes it easy for advisors to create contact records for leads obtained through social media advertising and retargeting campaigns. This feature streamlines the process of establishing contact with potential clients.

2. Lead Management: Wealthbox helps you organise and tag your contacts, making it easier to find and connect with prospects and clients using advanced filtering.

3. Data security: Wealthbox uses bank-level encryption and 256-bit SSL to protect your data. Passwords are securely hashed and stored and application credentials are kept separate from our database and codebase for added security.

4. Team Productivity: Wealthbox’s live activity stream and the commenting system let you keep track of what’s happening and communicate with your team in real time. Add some flair to your CRM updates and staff communication with emojis and stay connected with your advisors and assistants.

Zoho CRM is an omnichannel cloud-based software that helps businesses take charge of their operations and establish enduring relationships with their clients. With Zoho CRM, companies can manage their sales, marketing, customer support and other business functions on one platform. This gives companies a complete view of their customers and provides them with a better overall experience.

1. Lead Capture: Streamline your lead capture process with Zoho CRM’s effective lead generation forms. These forms provide an easy way to collect and organise lead information and our templates make it simple to get started.

2. Lead management: Use Zoho CRM to track and classify leads based on their interests and interaction with your website. Provide personalised educational content to establish trust and give leads what they want before asking for it.

3. Data Security: Zoho CRM protects your sensitive data with the power of AES-256 encryption. Keep your data safe from leaks and loss with our secure servers and transit protection.

4. Team productivity: By collecting data, processing payments, updating your CRM, sending emails & reports and doing whatever else you need, the Zoho Creator app can help you get the most out of your team.

5. Growth Hack: Zoho’s custom links are a great way to get information about your leads or contacts from any third-party application. You can use them to find your leads or contacts on Google Maps or LinkedIn or to view their profiles.

Here is the thing: Indeed, your business can probably still survive without CRM software. But if you want to achieve faster growth and more peace of mind, then a CRM system is worth considering.

For financial advisors, a CRM can help you stay organised, track and manage your clients and leads, predict and track your sales and manage your sales channels more efficiently. In other words, a CRM can help you better serve your clients and grow your business.

Of course, a cost is associated with investing in a CRM system. But a CRM is worth the investment if you want to take your business to the next level.

Or there’s an alternate option

You can take this information into nothing about it and one year down the line will be struggling with the same problems, stuck at the same level of growth or you can make a decision to move in the direction of faster, easier growth for you and your business.

You may be asking yourself, why should I buy Telecrm? The answer is simple: We want you to succeed. The most important thing is getting the results you want for your business. We’ll be rooting for you every step of the way.

With our help, you can ensure that your business gets the most out of its customer relationships.

We’ll work with you to ensure that you’re getting the most out of Telecrm and we’ll help you troubleshoot any problems. Our goal is to help you succeed, regardless of the software you use.

So, if you’re looking for a financial advisor CRM solution to help you take your business to the next level, don’t hesitate to contact us. We’ll be happy to help you get started with Telecrm and ensure you get the results you’re looking for.

Telecrm

Sage CRM

SugarCRM

WealthBox CRM

Zoho CRM

There’s no pressure! You can join our email list and receive free sales improvement tips from experts every week. When you’re ready to make a decision, you can contact our sales team!

© Copyright 2025 Telecrm.in - All Rights Reserved • Privacy Policy • T&C

© Copyright 2025 Telecrm.in - All Rights Reserved • Privacy Policy • T&C